In May 2018 the Mayor of London Sadiq Khan established the world’s first Electric Vehicle (EV) Infrastructure Taskforce.[1]

Since then, Transport for London (TfL) have continued to research the barriers preventing people from switching to EVs across London, and launched several campaigns based on their findings.

This case study examines the progress TfL have made in implementing their strategy for EV infrastructure, and the development of their strategy for 2030.

Current Successes and Challenges

One year on from the taskforce’s creation they published the London EV Infrastructure Delivery Plan.[2]

The plan recognised that current infrastructure was the largest barrier to large-scale switching to EVs. The report identified a set of enablers to overcome this barrier, as well as projected London’s infrastructure needs for 2025.

December 2019 saw TfL release guidance on charge point installation, enabling more areas to begin the necessary work in implementing EV charging stations.

The EV Coordination Body was launched in July 2020, led by London Councils. The body contributed to the One Year On report that was published later in the year.[3]

By December 2020, TfL had hit their target of installing 300 rapid charge points.

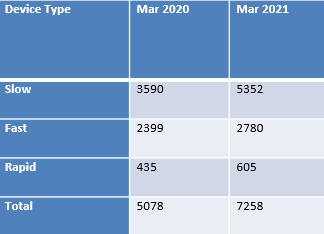

From March 2020 to March 2021 in London, the total number of charging devices for electric vehicles increased from 5078 to 7258.[1]

London now has 31% of the UK’s charge points, with the major hub sites being in Stratford, Greenwich, and Baynard House in the City of London.

They are also undertaking feasibility work to determine how Greater London Area (GLA) group land could accommodate EV infrastructure.

The task force are also exploring commercial opportunities for rapid charging hubs on TfL land. This could fit hand in glove with the electrification of buses, with there now being 485 electric buses and 15 garages with EV charging capability.

Other incentives given for people to switch to electric vehicles is the cutting of vehicle tax on zero emission capable vehicles. Vehicles that emit no emissions are also eligible for a 100% discount on the congestion charge after October 2021.

Taxis are also a focus point, with London now having over 4000 zero emission capable taxis. Drivers can get up to £7,500 towards a zero emissions vehicle via the ‘plug-in’ grant.

In addition, a £42 million fund has been established to support vehicle owners who want to delicense their older taxis. Dedicated e-taxi bays are being installed to accommodate the growth in numbers.

Whilst the above is promising, current public funding streams are coming to an end. This is coupled with the fact private sector delivery has not been as fast as initially anticipated, particularly with rapid hubs.

TfL believe London should have a clear strategy outlining:

- What the updated forecasts for EV infrastructure needs are

- How the public sector can further support the delivery of EV infrastructure

- How barriers for the private sector can be removed

- How much funding is required to achieve the long term goals

- How much support each area is going to need

Keys for Further Success

TfL posit that engaging with the industry throughout the entire process is key.

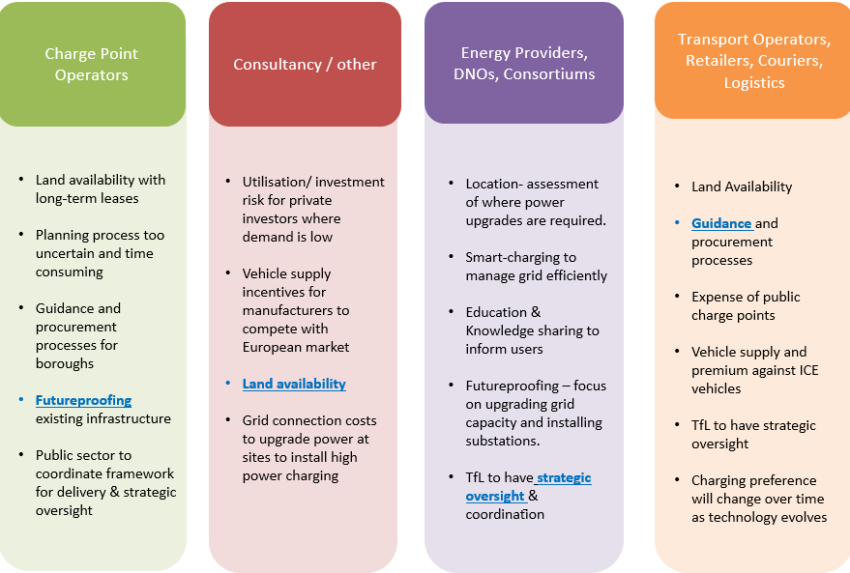

Industries contributing to the success of EV infrastructure delivery, or are keen stakeholders in the project, vary from transport companies, to energy providers, to land owners.

A breakdown of some key partners and stakeholders:

Transport Companies, Retailers, Couriers

- Amazon

- Enterprise

- Uber

- breatheEV

Energy Providers

- National Grid

- UK Power Networks

- British Gas

Landowners and Charge Point Operators

- Tesla

- Osprey

- Lendlease

Consultancies and Others

- Zero Carbon Futures

- RAC Foundation

- Baringa

- Cross River Partnership

By engaging with the market, the following themes have been identified.

Analysis of these themes has also helped target areas where demand is highest, and where energies need to be focused going forward.

The highest overall demand is currently in Central London, with South-East London potentially having the largest additional demand in the near future.

Another piece of analysis highlighted that most charging takes place between 9am and 9pm. There is relatively little activity overnight.

How the 2030 Strategy is Taking Shape

With the report due to be published towards the end of 2021, here are some of the key points to expect.

There will be an emphasis on continued market research to ensure policy maintains relevant and fit for purpose.

Market engagement will continue to be a pivotal part of the strategy, with new themes emerging at rapid rates.

User experience is expected to make up a larger part of the report, as more service users get to grips with the increased infrastructure it will be important to retain them.

The role of the public sector in supporting future delivery will be analysed in some depth, with purse strings for current projects being tightened.

Overall, the report will seek to continue the positives that have been seen over the past 3 years and undertake further research into how EV uptake might change post-Covid-19.

[1]Polyviou, Polyvios Dr. 2021. Strategy & Planning Manager, City Planning, TfL. Developing a 2030 Strategy for Fit for Purpose Electric Vehicle Infrastructure.

[2]TfL. 2019. London Electric Vehicle Infrastructure Delivery Plan.

[3]TfL. 2020. One Year On.

Register FREE to access 2 more articles

We hope you’ve enjoyed your first article on GE Insights. To access 2 more articles for free, register now to join the Government Events community.

(Use discount code CPWR50)