The finances of many sectors were damaged during Covid-19, the voluntary sector was particularly hard hit.

Anya Martin, Research and Insight Manager at the NCVO (National Council for Voluntary Organisations) [1] shared insights into the financial impact of Covid-19 on the voluntary sector and its long-term consequences.

The NCVO are the membership body for voluntary organisations in the UK, they represent and champion over 16,000 member organisations.

Financial Data on the Voluntary Sector

Last year when Covid-19 sent the country into the first lockdown, many voluntary organisations found themselves cut off from traditional sources of income.

Fundraising events stopped, in-person collections ended, charity shops closed, and the delivery of services was also halted. This presented a serious risk to organisations being unable to support their beneficiaries.

The NCVO worked closely with the Government to identify where organisations that were delivering central services might be struggling and the scale of support that they might need to make it through the period.

During the first lockdown, the NCVO scrambled to forecast the financial impact on the sector. Original estimates on trading and fundraising losses were found to be £6.5bn in lost income over a six-month period.

Consequently, in April 2020, the government pledged £750 million to ensure VCSE (Voluntary, Community and Social Enterprise) organisations could continue their vital work during Covid-19.

This included £200 million for the Coronavirus Community Support Fund, along with an additional £150 million from dormant bank and building society accounts.

The UK Civil Society Almanac

The NCVO use the UK Civil Society Almanac [2] as a source of information when mining data on the finances of the voluntary sector. The next version will be launched on the 29th of September.

It is an enormous source of information and includes data on:

- Income and spending in the sector

- Assets within the sector

- Fundraising ratios across organisations

- Organisation broken down by sources of income

This year’s Almanac tells us:

- There are 163,000 voluntary organisations in the UK, which is a slight decrease on the year before.

- The voluntary sector has an annual income of £56 billion and the vast majority of this spent on delivering charitable services

- Government funding has continued to decline as a proportion of the sector’s overall income

- The voluntary sector’s workforce has continued to grow faster than the public or private sector’s

Organisations can use the Almanac for things such as benchmarking and identifying trends in certain types of funding.

The Impact of Covid-19

Respond, Recover, Reset: A partnership project launched in 2020 from The Centre of People, Work and Organisational Practice at Nottingham Trent University, The Voluntary Action Research Group at Sheffield Hallam University and The NCVO was launched to understand what it has been like working in the voluntary sector during the pandemic [3].

The project produced real-time insights on how Covid-19 has affected the sector. It shares lessons learnt and opportunities for recovery.

A monthly barometer survey was distributed to organisations and ran across eight waves. Around 4,800 responses were received.

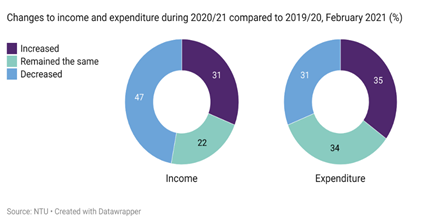

A range of questions relating to income and expenditure were included in the survey. They revealed trends in the financial landscape of the sector during Covid-19:

This shows a relatively mixed impact. Just under half of the organisations saw their income decrease. Fewer organisations saw their income increase over the last year and just under a third reported no change.

It is important to note that in a normal year it would be expected that far more organisations report increases in income.

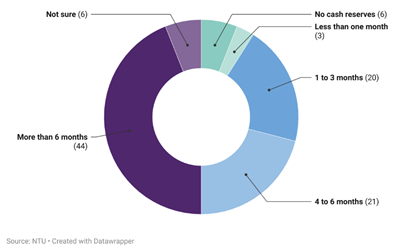

The survey also asked organisations about their cash reserves, and how long they would be able to function using reserves during the pandemic.

Figure 2: Duration that organisations can rely on cash reserves, February 2021 (%)

The recommended amount of reserve months varies based on the organisation; however, it is usually recommended that around 3 months of income should be saved in case of an emergency.

The largest group, over 44% of organisations had over 6 months’ worth of reserves, which is a comfortable amount. It is worth noting, that these were generally larger organisations in this bracket.

29% of organisations had less than 3 months of reserves, which is a concern during an unstable financial climate.

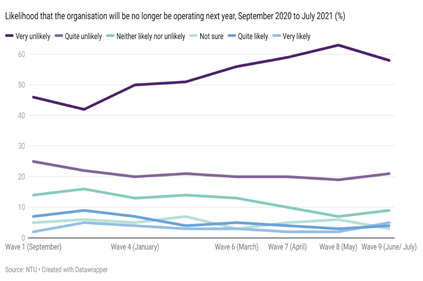

Finally, the survey wanted to measure the financial viability of voluntary organisations, so they measured their likelihood of survival during Covid-19.

Most organisations reported that it is very unlikely that they won’t be operating. This reflects a degree of resilience in the sector, however, a proportion of organisations could not be certain that they could survive the pandemic.

Conclusions

Across all measures, the financial impact of Covid-19 on the voluntary sector has been extremely varied.

Overall income decreased and some organisations faced a very serious risk of closure – however, the situation has been improving gradually.

The Respond, Recover and Reset survey has been useful in forecasting and determining the way that the sector responds to a financial emergency.

| [1] Martin, Anya. 2021. Research, and Insight Manager at the NCVO (National Council for Voluntary Organisations) [2] The UK Civil Service Almanac. 2020/2021 [3] Respond, Recover, Reset. 2020. The Centre of People, Work and Organisational Practice at Nottingham Trent University, The Voluntary Action Research Group at Sheffield Hallam University and NCVO |

Register FREE to access 2 more articles

We hope you’ve enjoyed your first article on GE Insights. To access 2 more articles for free, register now to join the Government Events community.

(Use discount code CPWR50)